By Clément Collignon, CEO, Sustaain

I used to be a Product Manager for Trading Softwares. In that life, the rules were simple: if a feature wasn’t in the spec, it didn’t ship. If the data didn’t validate the user story, you killed the feature. You defined the product, you built it, and you shipped it.

On the very first day of my career, I was tasked with building an Interest Rate Curve. Looking at the soft commodity markets today I not only see curves where financial theory does not apply (hello absence of arbitrage opportunities), I see a massive, industry-wide product failure.

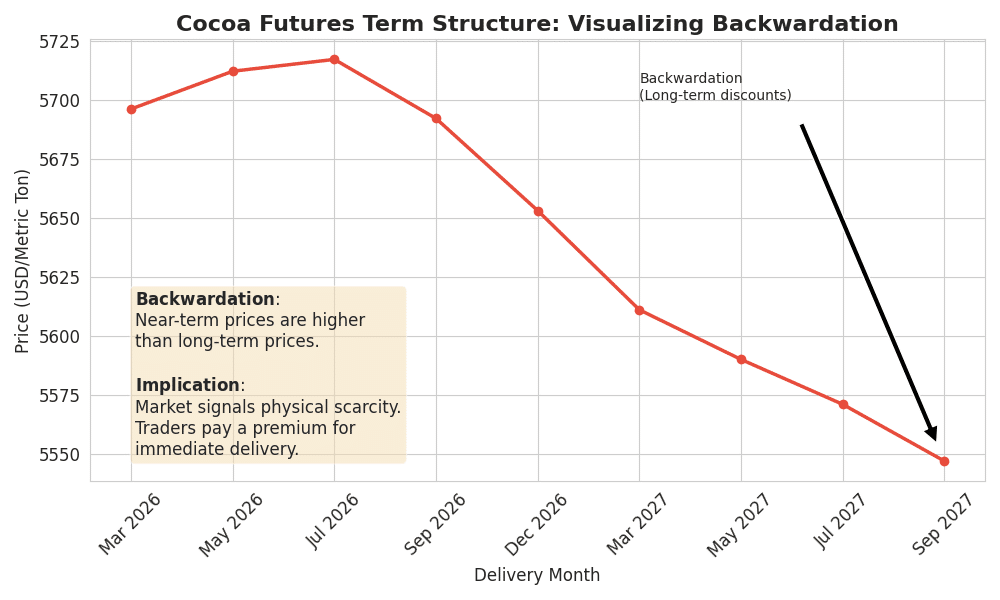

For a century, the “product” was simple: a physical bean that met a sensory profile (Grade 1, Screen 18, FAQ). The market dynamics traders are currently wrestling with – the basis blowout, the liquidity squeeze, the backwardation – are not just signs of physical scarcity. They are symptoms of a redefinition of the product itself.

The market knows the price is wrong. What the C-suite needs to accept is that the spec has changed. And right now, the global supply chain is struggling to ship the new version.

1. The “Breaking Change”: The Bean is No Longer Enough

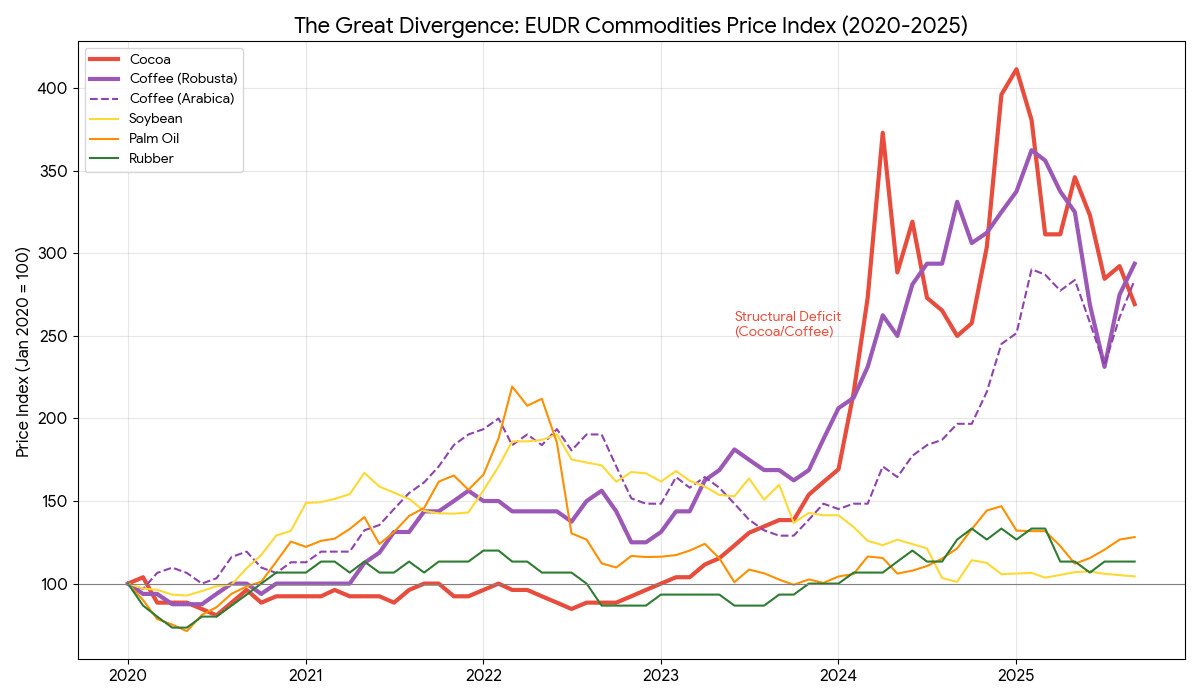

You know the market context: Cocoa is structurally broken, and Robusta is following suit. You don’t need me to tell you that high prices and volatility are painful.

But consider why the physical premium has disconnected from the futures terminal. It’s because the “futures bean” and the “physical bean” are no longer the same asset.

- The Futures Bean: A generic financial contract.

- The Physical Bean (Post-2025): A physical asset + a traceability proof + a polygon + a deforestation check + due diligence statement.

In product terms, the regulator (the EU) is shipping a mandatory update (EUDR) with a hard deadline (well, not so hard it seems…). The industry is trying to patch a legacy backend (analog supply chains) to support a modern frontend (digital traceability).

2. Traceability is Not Compliance; It’s Inventory Control

Many stakeholders in the soft commodities space still view traceability as a “sustainability tax”. For them, it’s a compliance cost to be minimized. This is a strategic error.

In a world of structural deficits (which we are likely entering for cocoa, coffee and a wide variety of agriculture products), data is your only inventory control. If you cannot see the farm, you cannot predict the yield. If you cannot predict the yield, you cannot hedge the risk.

The traders winning in this environment are not the ones with the biggest warehouses; they are the ones who converted their supply chain into a data lake years ago. They know which cooperatives are replanting, which ones are digitally mapped, and which ones will survive the “compliance cut.” If you don’t have the data, you don’t have the volume. The “invisible hand” can no longer find invisible commodities.

3. What to Expect Next: The “Identity Preserved” Economy

So, where does this settle? As we move past the initial shock of implementation, expect two structural shifts. To understand these, we must reconcile how the London “Premium” of 2024 evolved into the London “Quality Discount” of 2025 and 2026.

A. The Great Bifurcation (Two-Tier Pricing)

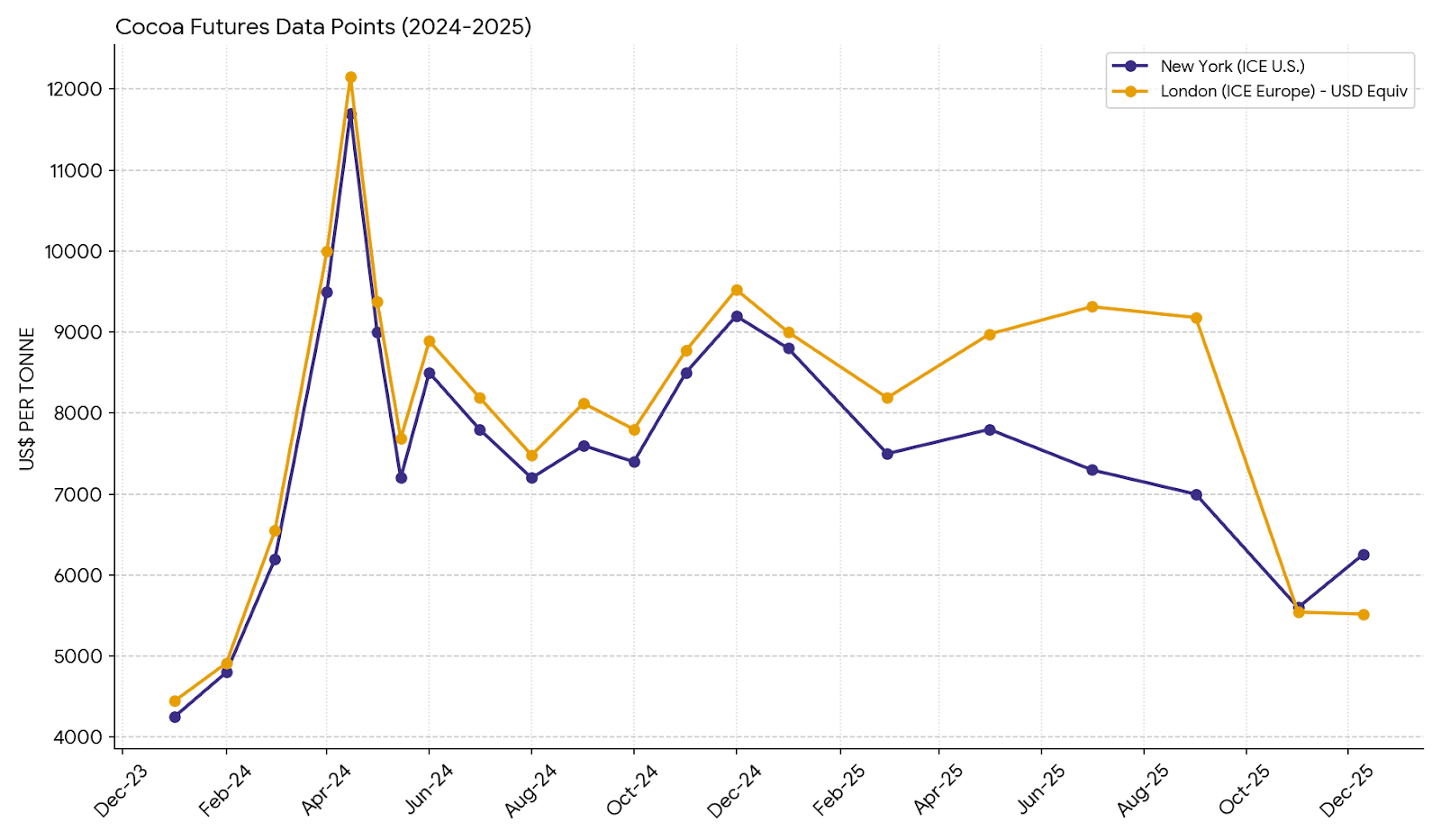

We are seeing a permanent split in the price structure between Tier 1 (Compliant) and Tier 2 (Legacy) materials. Trading strategies must now account for a widening spread between these tiers, a reality reflected in the diverging roles of ICE London and ICE New York.

1. The Scramble for Nearby Beans (Backwardation) Throughout 2024 and early 2025, the cocoa market was in a state of extreme backwardation, where near-term prices traded at a significant premium over future contracts.

- The Scarcity Premium: Because London is the primary benchmark for West African origins (Côte d’Ivoire and Ghana), the failure of those crops hit London inventories first and hardest.

- Factory Needs: European processors needed beans immediately to fulfill existing contracts. They were willing to pay a massive absolute premium for whatever was already in London warehouses, regardless of whether it met the new 2026 “digital specs”.

- The Inversion: In late 2024, extreme supply tightness drove the market into a deep inverse, with nearby contracts reflecting urgent competition for depleted terminal stocks.

2. The Absolute Price vs. the “Basis” Premium It is important to distinguish between the absolute futures price and the commercial basis.

- London (The Physical Surcharge): Its higher price in mid-2024 reflected a “here and now” emergency. By June 2024, London cocoa reached a high of $11,530 per tonne as European stocks declined by 47%.

- New York (The Quality Premium): While NY’s absolute price eventually hit records (peaking at $12,565 in Dec 2024), it was increasingly viewed as the “Premium Basis” for future-dated contracts. Manufacturers began shifting long-term buying to New York because they knew NY inventory, enforcing stricter bagged-delivery standards, was far more likely to be EUDR-compliant by the 2026 deadline.

3. The 2025 Pivot: Why NY is Now Higher The “Compliance & Quality” logic became the dominant driver of the absolute price once the physical panic subsided.

- Improved Supply: As West African yields recovered in late 2025, the “emergency surcharge” in London vanished. By late 2025, cocoa port arrivals in the Ivory Coast were up significantly compared to the previous disastrous season.

- The EUDR Deadline: As the implementation date approached, formally set for December 30, 2025 for large companies, the market “dumped” legacy London beans. London prices collapsed nearly 60% through 2025, falling faster than New York’s, leading to the NY Premium observed as we enter 2026.

Current Snapshot: January 6, 2026

The “Identity Preserved” era is now reality. The market has fully transitioned from a Physical Crisis (where London was higher due to scarcity) to a Compliance Crisis (where New York is higher due to data integrity). With cocoa re-entering the Bloomberg Commodity Index (BCOM) this month, the “Tier 1” compliant bean has solidified its place as a distinct, premium financial asset.

B. Integration and Refactoring of Origins

The era of spot-buying “anonymous” coffee is ending for major brands. To guarantee the data, you must guarantee the relationship. Expect a wave of Mergers &Acquisitions or deep Joint Ventures where traders effectively become “remote procurement departments” for Fast Moving Consumer Goods, managing the digital twin of the farm as closely as the physical logistics.

Just as a PM refactors code to make it efficient, the market will refactor origins. Sourcing from millions of unmapped smallholders is becoming operationally expensive. We may see a shift toward larger, organized estates or cooperatives that are “API-ready”—capable of pushing data as easily as they push bags.

Shipping the New Version

The volatility of the 2020s is not a cycle; it’s a migration. We are migrating from a trade based on volume and opacity to a trade based on value and visibility.

As a former PM, I’d say the “user requirements” have changed permanently. The consumers (and regulators) demand a product that doesn’t cost the Earth. The market is frantically trying to build the features to deliver it.

The C-suite leaders who treat this as a data challenge (rather than just a sourcing headache) will be the ones who successfully ship the product in 2025 and beyond.